- Weekly Dose of Random Knowledge

- Posts

- How to Invest Your Money in 4 Steps (like growing a plant 🌱💵)

How to Invest Your Money in 4 Steps (like growing a plant 🌱💵)

The guide I wish I had when I started

Think of investing like growing plants, a healthy sprout would never become a tree overnight; investing is the same, it needs time. Here, we need to differentiate investing from trading. Trading refers to a short-term gain, where you buy a share of stock and sell soon after. Investing is a long-term process, a successful investment usually correlates with a stable and profitable company, or an uprise of the economy.

Now I will give you a 6 step guide to start investing your money. Seriously, don’t let your cash just sit there and watch inflation skyrocket.

Have $10+ in your hands.

You don’t have to have a lot of money to start investing. Some companies would give you hundreds of dollars to open an account with them. Even if you have no money, you can start learning how to trade with Paper Trade. Most companies offer the Paper Trading feature, which they will give you fake money and you can practice trading with it.

Find a Brokerage/Broker

A brokerage/broker is the intermediary that connects you to the company so that you can buy their stocks. Similar to how you purchase things through Amazon. So whenever you want to buy a share of a company, you do that through the broker. Some common brokerages are

Fidelity (what I use)

Robinhood

E*Trade

TD Ameritrade

Charles Schwab

Vanguard

All these brokers do the same jobs with small differences. I started with Fidelity because it’s student-friendly (they gave me $100 for opening an account) and easy to navigate. I recommend it.

After finding a broker and starting an account with them, you can transfer your money into that account and start investing.

Buy ETFs

ETF stands for Exchange-Traded Fund. It’s a collection of stocks that are traded as one. For example, if you wanted to buy a share of Apple, Microsoft, Tesla, Meta, and Amazon, but you don’t have the money or the patience to buy every single one of them, you can then buy a share of an ETF where each of these five companies makes up twenty percent of that share of ETF.

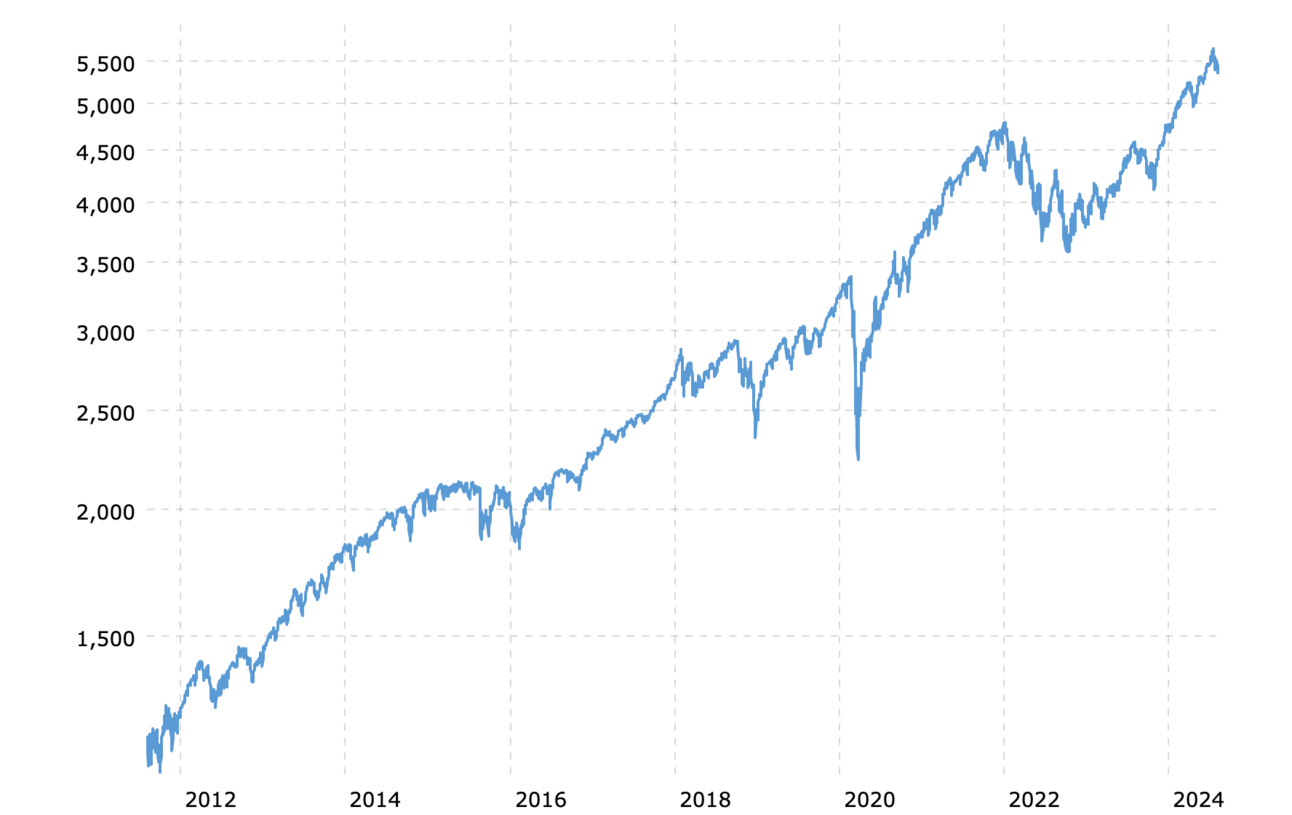

The most common type of ETF is S&P 500. It’s a collection of the stocks of the top 500 companies in the US, so buying one share of this equals buying all the top 500 companies in the US. By buying this, you are essentially betting on the increase in value of the US economy, which is highly probable. Since the Great Depression in the 1930s, the S&P 500 has been at a steady climb rate of 10.7% each year.

data from macrotrends

For the past ten years, the average return rate of S&P 500 has been 10.2%. Not a single company or any other mutual fund has ever consistently beaten the market (S&P 500). If you are looking for an easy and stress-free way to invest your money, this is the way to go.

Each broker has their own version of S&P 500, they just tweak the percentage of some companies and result in slightly different outcomes over time. I invested in Fidelity’s S&P 500, which is called the Fidelity 500 Index Fund (FXAIX). I invested last year summer, and currently have a total gain of 17.75%. It’s doing extremely well considering many of the top tech company’s stocks are plummeting right now.

Wait (don’t react to the market), and expect long-term profit in ten years.

After finding a brokerage and investing your money in an ETF, it’s your time to sit back and wait. You can log into your account once in a while, but don’t overreact when you see the prices drop. Almost certainly, it’s going to come back up, just a matter of time.

Thank you for reading my first post, I just started with something easy for me to write. I’m open to all kinds of feedback so please email me if you have any. Oh and let me know if you have a request of any kind. If you enjoyed this article, please share it with your friends!